Where should I put my 401k?

While I am not an investing expert, I have always loved math and been pretty good at it. I even majored in it in college. In fact back in college, I took a lot of math and economic courses about predictions. I remember I had one course called Financial Econometrics, where I asked the professor if we could use the financial models we were learning to predict the stock market? He said,

"Absolutely not."

Well, at least that's what I remember. I remember him going into details about how just looking at the dollar amounts of stock prices alone doesn't give enough information to make good predictions, though I do remember him saying looking at macro economic factors such as like crop yeilds and prices can be a decent predictor of the economy at large or something like that. I cannot claim to be an expert in this area. I took that course without taking the direct pre-requisite (cause they were all full and only offered in the fall and I wanted to study abroad the next fall) and I got a well deserved D.

Anyway, while the past prices of a given stock may not be enough to predict the future performance of a given stock, I do believe that some analysis of the stock market is acually useful and helpful. I think I may have been young and naive and not really understood what my professor was saying about stock prices and predictions. I may have just drawn the conclusion that analysis of stock prices was a waste of time, and never questioned it.

I don't think this is a smart idea anymore. Especially after spending time with my Grandfather and hearing about the power of compounding interest. He had me do this exercise where I would save 10% of my salary each year and invest it in the stock market which would go up at 6% per year or something like this. I was amazed at the total it made by retirement age… It was way more than just saving that amount each year.

For example, investing $30,000 (the default dollar amount in the online retirement calculator I used) at a rate of return of 6% per year will give about $300,000, adding no additional money at all! Imagine adding in more money each year!

However, since talking with my grandfather about this, I heard Warren Buffet say the average investor should just put their money in an ETF that follows the stock market and leave it for a lot of years and that will do better than most investing strategies out there. He's the greatest investor of our time, so I decided to look more into this and try to understand why he said that.

To do this, I learned more about ETFs and average stock market returns, and I played around with a retirement calculator a bit. What shocked me even more was how much of a difference the rate of return makes over many years. For example, investing $30,000 at a rate of return of 13% per year (instead of 6%) will give about $6 million, adding no additional money at all! That's a lot more than the $300,000 at 6%. There are a lot of simplifying assumptions here though that I don't really think we can make in reality. The market doesn't output 6% or 13% per year like some machine. Some years and even decades are good or bad and significantly deviate from this.

While it definitely seems like investing at all is a good thing, learning about this got me thinking that maybe I should do some further investigation. Another way: with a difference that massive, it's very much worth understanding what is actually going on here. What is realistic and what isn't?

So in order to do this, I wanted to compare investing in a "high yeilding" ETF with some more standard investment that is safer, like investing in bonds or something.

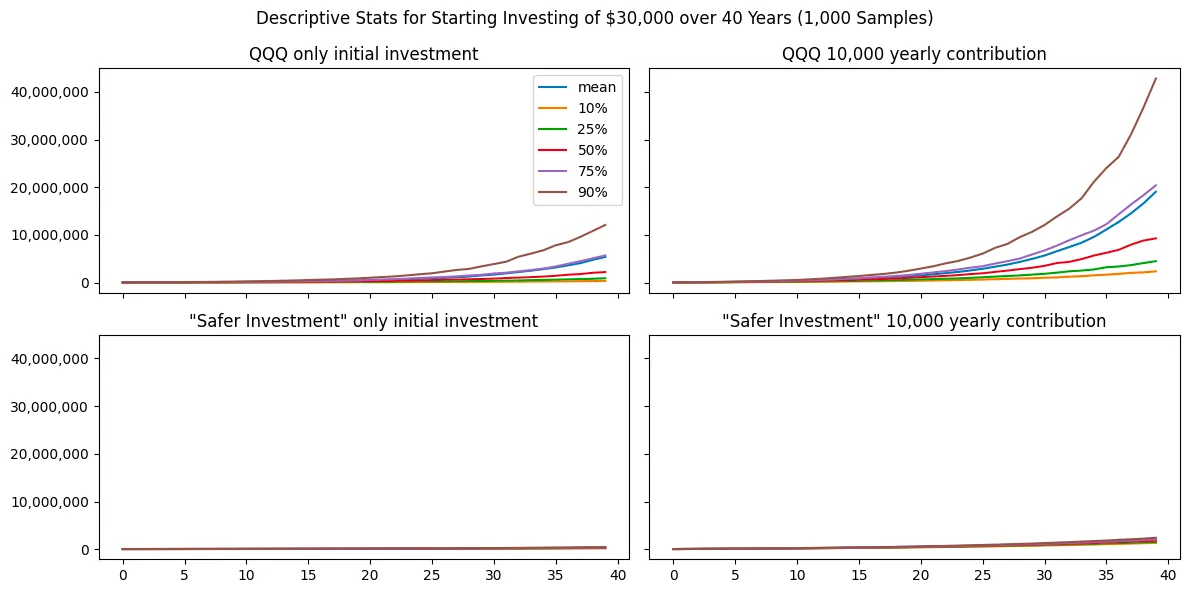

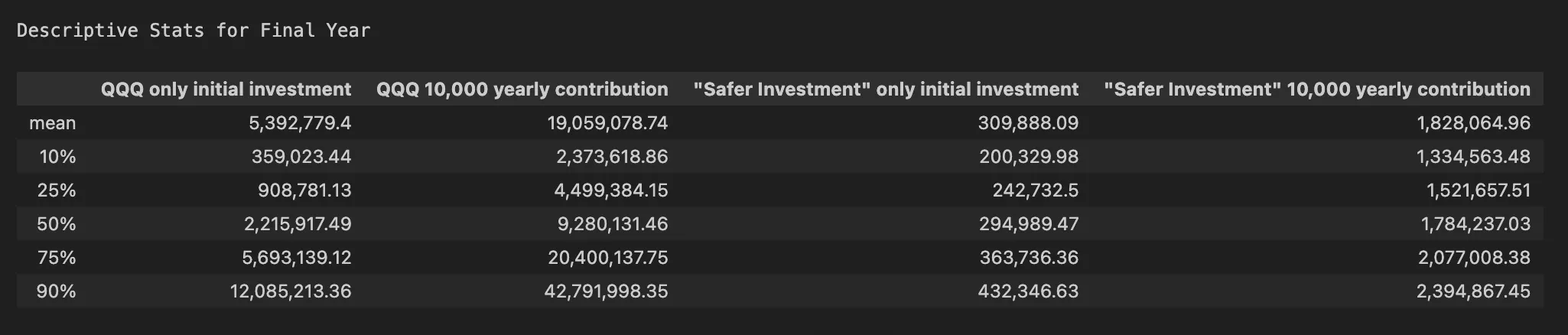

I found an ETF called QQQ which seems to have high returns on average, and I assumed we could model the yearly return of both of these investments as a normal distribution. QQQ has an average return of 13.77% and a standard deviation of 23%, and for the comparison I chose a return of 6% and a standard deviation of 5%. I sampled these distributions once per year for a 40 year time horizon (40 data points), and calculated what the expected return would be each year for varying scenarios, if I had $30,000 to invest. In one scenario, I would simply leave the money in the invesment for 30 years, in another I would add in $10,000 yearly, for both QQQ and the alternative. I did this experiment 1,000 times, then took some summary statistics for the amount of money in each year and plotted this to give an idea of what would be more realistic. I feel this is more realistic than the simple retirement calculator because it encompasses randomness into the returns. I think this should give a better understanding of what to expect from these scenarios in the future.

Below are the graphs, then summary statistics for the amout of money left in the last year of each scenario.

While I know that market returns are not really normally distributed, I feel like this does help me draw some important conclusions. Like a less risky asset over a longer time horizon essentially means "we are more sure of having less money in the end." This might be desirable for people with large quantities of money that want it to grow in a predictable low-risk fashion. However, not needing to withdraw the money for many years means that riskier assets such as QQQ, will likely give a lot more money than a safe investment. For example, 50% of the time investing $30,000 in QQQ and leaving it will be between $900,000 and $6 million after 40 years, and it will only be less than leaving it in an asset returning 6% per year 10% of the time.

It seems really foolish to leave my money in something with a low rate of return given that I am able to leave it in the market long enough to weather some storms. That being said, I don't think just leaving a chunk of money in an ETF with a high rate of return for 40 years is guaranteed to make me rich. Adding more money over the years is one way to be more certain of the fact that I will be able to retire, and quite clearly putting the money in an asset like QQQ will likely give much more money than something that returns 6%.

I don't know what the downsides to this approach would be. I feel like it should probably be the default to put money in something like QQQ if I do not need it for many years. This way I do not have to actively monitor the stocks/company and it will still increase a good amount over the years.

Then I can make more specific investments if I am sure that it is better than QQQ or a similar ETF. I am not confident in my ability to do this with any sort of reliability, but at least I can put some or most of my money in safe assets that will grow, while I monitor the stock market and see if I am any good at identifying value before the market does.

This all being said, there are a lot of assumptions that this analysis makes, such as markets having normal returns per year, that the person calculating the normal distribution parameters of QQQ did it right, and even that I will even live 40 more years. However, I can't see the future (if I could I'd be a lot richer than I am now), but I think this is still a really informative exercise. I am glad I did it and that I am expanding my knowledge in this direction.

In sum, I should put my 401k in the asset with the highest average rate of return for the longest period of time. The reason I add fot the longest period of time is that the average rate of return of the the S&P 500 between 2019 and 2023 is about 19% per year. Seeing an asset returning that amount or less, having been started in 2019 might mean it's not as good as the numbers might say.

Thanks for reading. I hope you learned something, along with my journey to learning about money. And if you know a better way to model return prices of market, please let me know!